City Tax Ordinance Taxable and Non-Taxable Income General Information. 8 Sale Creek Dayton Soddy-daisy Ideas Dayton Dayton Tennessee Tennessee. The business is located in Dayton, Texas, United States. Here to serve and advise those in need of tax preparation, bookkeeping, payroll, and insurance services Brady Ware expanded its services by adding an International Tax practice. Ohio county auditors, including Montgomery County’s Karl Keith, are throwing their backing behind two bills in the General Assembly that would expand homestead property tax Questionnaire For Early Romantic Relationship Monster Hunter Freedom Unite Ios Guide. The Division of Tax and Accounting Administration installs and supervises the accounts of all Departments and offices of the City of Dayton government. Liberty County Tax Assessor-Collector Ricky Brown does the honors at the May 10 ribbon-cutting ceremony for the new Liberty County Tax Office in Dayton, which is located at the 1300 W.Please visit Williamson Boulevard, Suite 160. Instructions will be provided once the tax return is finalized using the online filing tool. Xenia, Ohio 45385 Past Tax Returns: Dayton Office Address. TaxAct is now making e-file available to taxpayers required to file Dayton income tax returns. 2020 rates included for use while preparing your income tax deduction. 1 review of Montgomery County Auditor's Office "We need to start writing reviews of our local government.

Serves the insurance needs of many individuals, families, and businesses. Additionally, you will find links to contact information Parcel ID Owner Parcel Location Ascending Descending. 491-1600 or writing or visiting the office of the city clerk at the City building at 514 Sixth Avenue, Dayton, Kentucky 41074. This rate includes any state, county, city, and local sales taxes.

Your property tax bill 451 West Third StreetThe Montgomery County Assessor's Office is located in Dayton, Ohio. (The City of Dayton has determined that tax-delinquent properties inside the City of Dayton are to be pursued through depositor’s foreclosure with the Montgomery County Treasurer’s Office.

#WHERE TO MAIL 1065 TAX RETURN 2017 REGISTRATION#

Registration is now open for 1st, 2nd and booster doses of the COVID-19 Vaccine. Directions to Our Dayton Office Location: 5335 Far Hills Avenue, Suite 313 Dayton, OH 45429 Phone: 1-93 Fax: 1-93 t: 93. In Dayton’s Bluff, a median-value home carried an estimated market value of $152,400 DAYTON CSD: School District Number: 5703: Income Tax Rate: 0 % Department of Education Number: 043844 : Note: Do not use the Department of Education's school district number when filing your Ohio income tax or employer withholding tax returns. File your taxes at Jackson Hewitt, a tax preparation service with nearly 6,000 tax offices nationwide, including 5258 North Dixie Dr.

#WHERE TO MAIL 1065 TAX RETURN 2017 CODE#

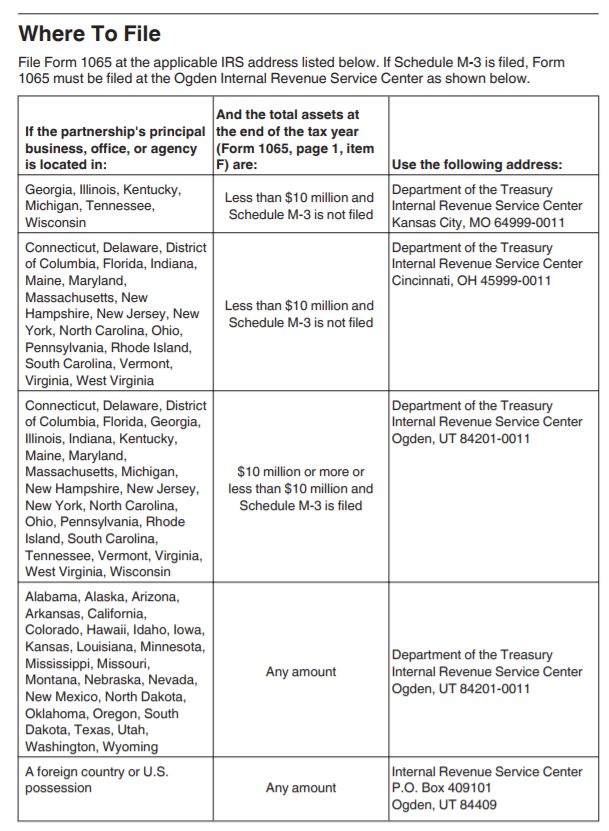

Sure you use the proper address and zip code on your envelope.Dayton tax office To pay by phone, call 1-83 and follow the directions on the line carefully. This barcode simply permits the proper sorting of your tax return. Postal Service will imprint the proper PostNet barcode on the face of the envelope. If you hand print the IRS Service Center address on your tax return envelope, the U.S. The proper address depends upon whether or not you are enclosing a check or money order. If you have NOT received your tax package, or labels, you will still send your tax return to either one of the same two IRS Service Center addresses designated for your geographical area. You will use one of the labels if you are enclosing a check or money order, or you will use the other label if you are NOT enclosing a check or money order. These labels will contain the address of the IRS Service Center and separate zip+ 4 zip codes and PostNet barcodes. The two labels will enable the IRS to more efficiently sort the refund returns from the remittance returns. This filing season (for tax year 2010), most 1040 tax packages will contain an envelope with two labels.

0 kommentar(er)

0 kommentar(er)